According to the National Credit Union Administration (NCUA), an independent federal regulatory agency in charge of the credit union industry:

Our Credit Union vs. Banks

The bottom line for the difference between credit unions and banks is profit–while banks are larger, for-profit businesses that operate in the interest of making the bank more money, our credit union is a local nonprofit institution invested in serving our members. As a member-owned organization, USECU operates by its members, for its members. This allows us to offer competitive interest rates, better customer service, and member benefits and financial services tailored to the needs of our USECU community.

Our History

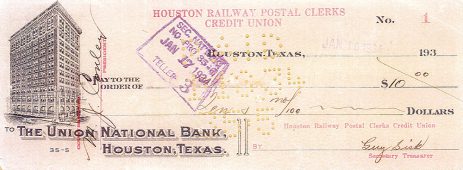

Our first check, dated January 10, 1934.

Our credit union was originally chartered in December 1933 as the Houston Railway Postal Clerks Credit Union. Following the tradition of “one member, one vote” our credit union has undergone frequent name changes reflecting our continual growth in our scope of membership.As USECU, or United States Employees’ Credit Union, our credit union started in Downtown Houston, TX for government employees in the area. In 1998, we expanded with community charters and in 2008, USECU moved to Tomball, TX to establish our first standalone building.

In the over 10 years since, we have worked to develop the USECU community in the surrounding area and build up our membership. Today, USE Credit Union has over 9,000 members and remains dedicated to our mission of serving our members in all their financial needs.

Our Mission & Our Commitment to You

Encourage members’ personal success through exceptional financial services today and tomorrow.

As a part of our credit union, you’re not just another customer–you’re a member-owner. You own part of the credit union and we’re dedicated to work for you. Whether you’re looking to save money or borrow through loans, our friendly and knowledgeable staff is ready to help you with all your financial needs. Our success as a credit union is directly dependent on the success of our members, so let us help secure your finances for you and your loved ones.